There is one big pitch deck test you need to pass.

It will dictate not only if you will get an email which says ‘Let’s meet’ or… if your pitch will even get read properly.

That’s scary, right?

Let me tell you about it.

Being an investor sucks

You probably think being a venture capital investor is like hitting pay dirt! The fame, the (potential) fortune, the um, whatever else. Well, not exactly.

Very little about the downside of being an investor is shared.

- You’re a glorified librarian. You read all the time, you study trends, industries and technologies. yeah, if you are a nerd, that’s fun. But it’s a lot of work to always pretend to be an expert

- Fundraising is a beatch. You think raising a seed is hard, try raising a hundred or so million every 2/3 years! I’ve never met an investor that enjoys it (only one person, who said they were good at it)

- You get pitched all the time. Yes, you’re in the john and someone will pitch you…

- Most investors don’t perform. That’s right, most investors are not good at their job… but that’s because it’s better to be lucky than good

- Your job is to read pitch decks. Let’s focus on that

The vast majority of pitch decks not are terrible. The worse thing is that founders probably spent ages writing those terrible decks with no help! But as an investor, you need to read the deck.

This is what happens:

- You get a cold email or a warm intro. Let’s pretend it’s the later

- You read the email, which can be well-written, or not

- You open the attachment, click a link, and then wait for it to open

- You look at the first page… is this going to be great?

- You flick through the deck

- If it’s good, you read through it and make a call if you want to learn more?

- If the deck sucks, now you have to message the founder and the person that made the intro and explain why you pass… the founder may respond again for more info and now you wonder if you should reply. If you do it will not be the only email…

- If the deck is good, you org a meeting

VCs get up to 1,000 decks a year. Some of the big name VCs will get more deal flow (a16z says 3,000), which isn’t necessarily good as… that process needs to be repeated.

The min you are doing this process is 5 times a day… every day. Every single day.

On top of this, you are trying to get deals done, you may be fundraising for the new fund, you have board meetings, some deals are going sidewards and taking up time, you have LP reporting and all those speaking engagements…

There isn’t a lot of time, but you have to read those pesky pitch decks, right?

A lot of the time founders don’t internalise that reading decks sucks. Every founder thinks they are special and deserve investors’ time, but they don’t put in the effort to make it easy for investors to get a proper yes or no. It’s too hard to read.

He hardly spent any time reading my deck! What a dick. If only we could have an hour meeting, then I can explain it and get the deal done!

Oh great, so instead of a quick read of a deck, the investor needs to spend at least 5 hours a day meeting each and every person that emailed them? Um, ok.

Understand why you get a ‘Thanks Jim, This isn’t for us but come back when you have more traction. Best, Peter”?

What are the stats on decks?

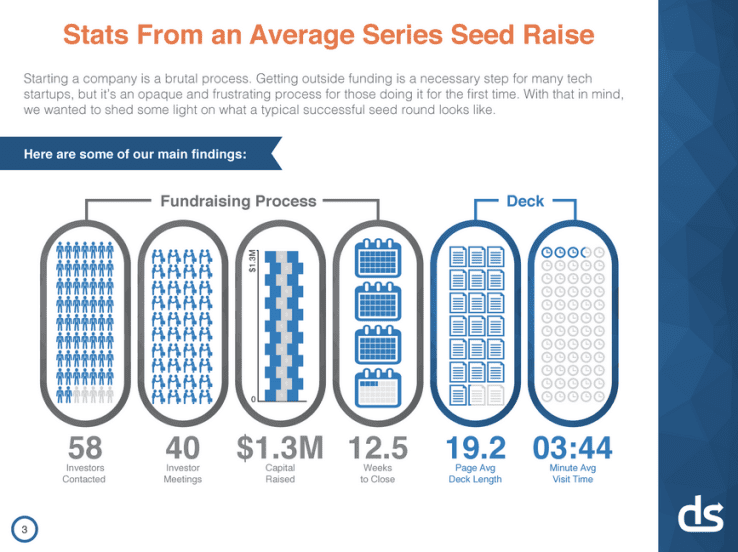

Interested to know what the stats are on time spent reading decks? Well, that’s pretty hard to get, but DocSend (Similar to Attach, which we recommend to use when fundraising) studied more than 200 pitchdecks from angel to Series A. They partnered with Harvard Business School professor Tom Eisenmann to look at companies which have cumulatively raised $360 million in total.

Here’s a summary page:

3 minutes and 44 seconds. That’s the time that they tracked for investors reading pitch decks. Not that long, right? I think the number is more like 2 minutes in many cases.

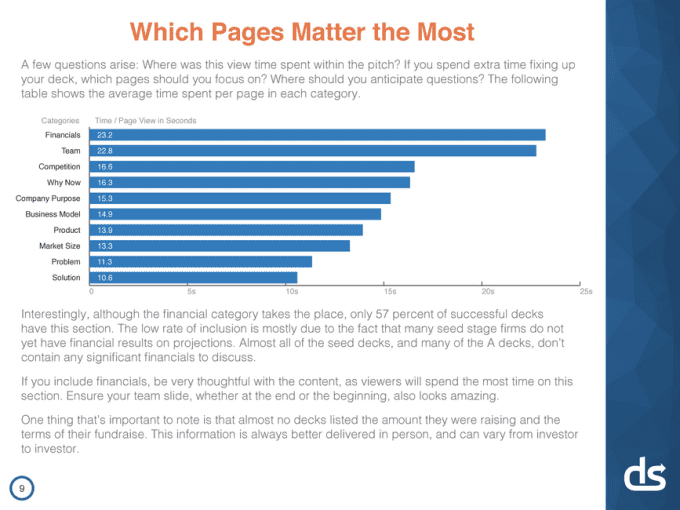

The implication of this time commitment is that investors spend an average of 11 seconds per slide. But that’s the average. Investors spend more time on certain slides. Docsend says they will spend about 20 seconds on certain slides such as the financial and team page. The implication being other slides get far less attention on average, maybe it’s more like 5 seconds… That’s not long to get your point across!

Do you want to know some interesting math I just did? If you have 58 investors reading a deck for 4 minutes, then cumulatively investors spent 4 hours having a quick, first look at one startup’s deck. There are hundreds of thousands of startups raising at any given time. Maybe there is a startup to filter startup pitch decks 😉

Whatever way you cut it, you have very little time to get investors’ attention.

What do founders need to do to get the attention they deserve?

Don’t get in your own way! Write the deck with copy you would like to read if you were to only spend a few seconds on each page, and a few minutes in total.

- Get to the point!

- Make your point clear

- Remove all fluff. No erroneous words and puffery

- Use larger text to get the most attention, use smaller words where the text is secondary

- Use visuals to make the deck engaging

- Use proper contrast to ensure content is easy to read

The flick test

After years of reading decks, our founder devised a simple test based on reflecting on how he approached the process of reading decks. It’s called ‘The Flick Test.’

The Flick Test: a binary pass or fail test, wherein an investor decides whether he will give a deck a second pass based on flicking through a pitch decks’ pages in rapid succession, only pausing momentarily if something grabs him

How does this work?

- Open up your deck and every 5 seconds press down

- You have 5 seconds to read each slide of the deck

- If at the end of the deck you can explain what the company does and why it is interesting you pass. If not, you fail

If you want feedback from a friend or contact, make them take the flick test. Give them 2 minutes to review the deck, no more. Then get them to explain what you do and why it is interesting. If they relay the message you intended, you are doing well, if not then you need to reflect and act!

Why the flick test matters

You wrote a deck for a reason, right? You have a goal in mind and that goal is cash in the bank from someone awesome!

So if you put on an investor’s hat and do the flick test on your own deck, question:

- Is your awesomeness shining through?

- Could someone truly understand what it is you do?

- Would they understand the magnitude of the opportunity, why now is the right time, why you are the team to do it?

- Would you respond to org a call asap!?

- Do you want to get your own wallet out?

- Would you allow your parents to mortgage their house on this?

Do you pass the flick test?

The key thing to pass the flick test

What’s the first thing you read on a slide?

The title, right?

Ensure you are telling the story through the title! If you only have 5 seconds to read each page, you can be darn gosh certain that it’s the title that you are reading first.

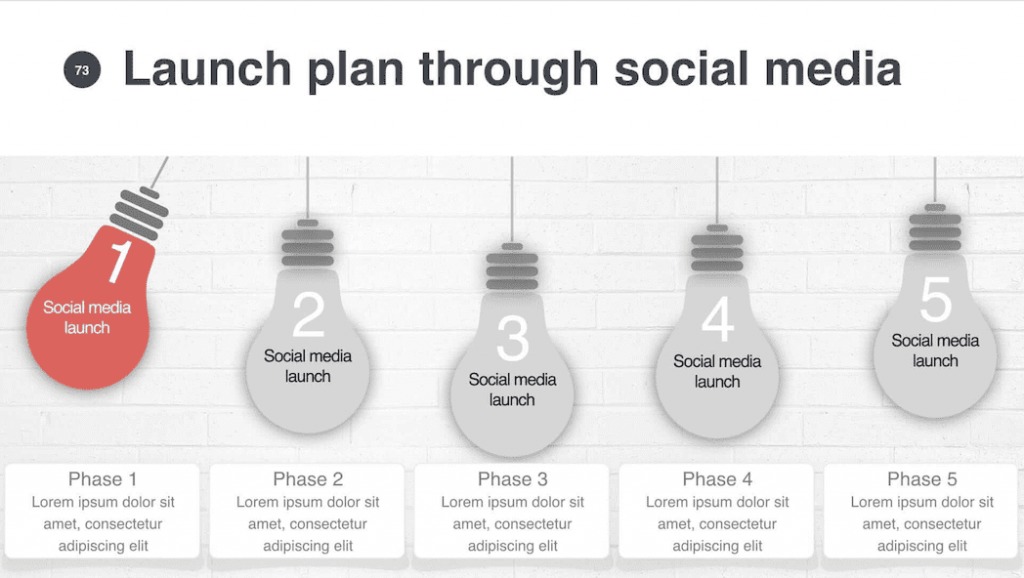

Here is an example of a slide we made (anonymised).

The title is a generic one to explain your launch plan (so it’s not crafted!)… but it’s easy to read and gets the point across right? You can then parse through the light bulb moments really quickly to understand the five steps in the plan, and then the key details of each plan through the boxes.

It’s a painless experience, right? Make painless your plan.

That’s it. It’s a simple but powerful test for you to internalise. It’s certainly not easy to implement in reality, but it’s the only test that matters when you are looking to get that first meeting with investors.

What do you think? Do you have any great learnings you want to share? Sound out in the comments below!

If you are raising, do you don’t have an excuse to not have a beautifully crafted pitch deck with Perfect Pitch Deck. Head here now.

Join the pitch deck thinking course

Join and get 11 daily emails on the key topic no one talks about